Our Investment Strategy

STRATEGIC CORNERSTONES

6 Point Cornerstones developed to yield sustainable returns and long term value creation.

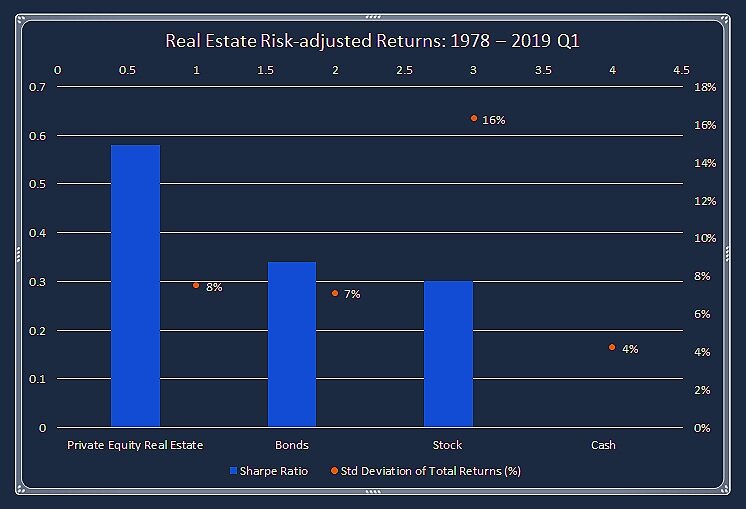

RISK ADJUSTED RETURNS

Real estate returns have out-performed relative to other investment categories on a risk adjusted basis.

THESIS

A defensive housing and healthcare real estate anchored investment multi-strategy, with income protection and uncapped upside potential.

BLENDED PORTFOLIO

Multi-strategy focuses on downside protection and uncapped upside potential.

Multi-faceted diversification across and within select asset classes, geographic markets and the capital stack.

STRUCTURAL OPPORTUNITY

Multi-dimensional portfolio construct comprises blend of robust, higher certainty investments with durable real estate that benefits from dislocations in ever increasing probabilities of complex payoff scenarios.

CAPITAL STACK DIVERSIFICATION

Investment strategy across the capital stack allows for risk re-balancing and wealth protection whilst benefiting from private market inefficiencies.

SECTOR RESILIENCE: SENIOR HOUSING

Seniors - One of the most recession-resilient, creditworthy tenants relative to other commercial real estate sectors.