Angelo Giudice MBA (MIT), Co-Founder and Principal of Magna Legacy Partners.

I am truly proud of the team we have assembled and excited about the challenges of the future built environment. With decades of direct experience and standout achievements in all facets of healthcare and related real estate, we believe that our niche real estate strategy is resilient and forward-looking whilst staying true to the mission of improving lives.”

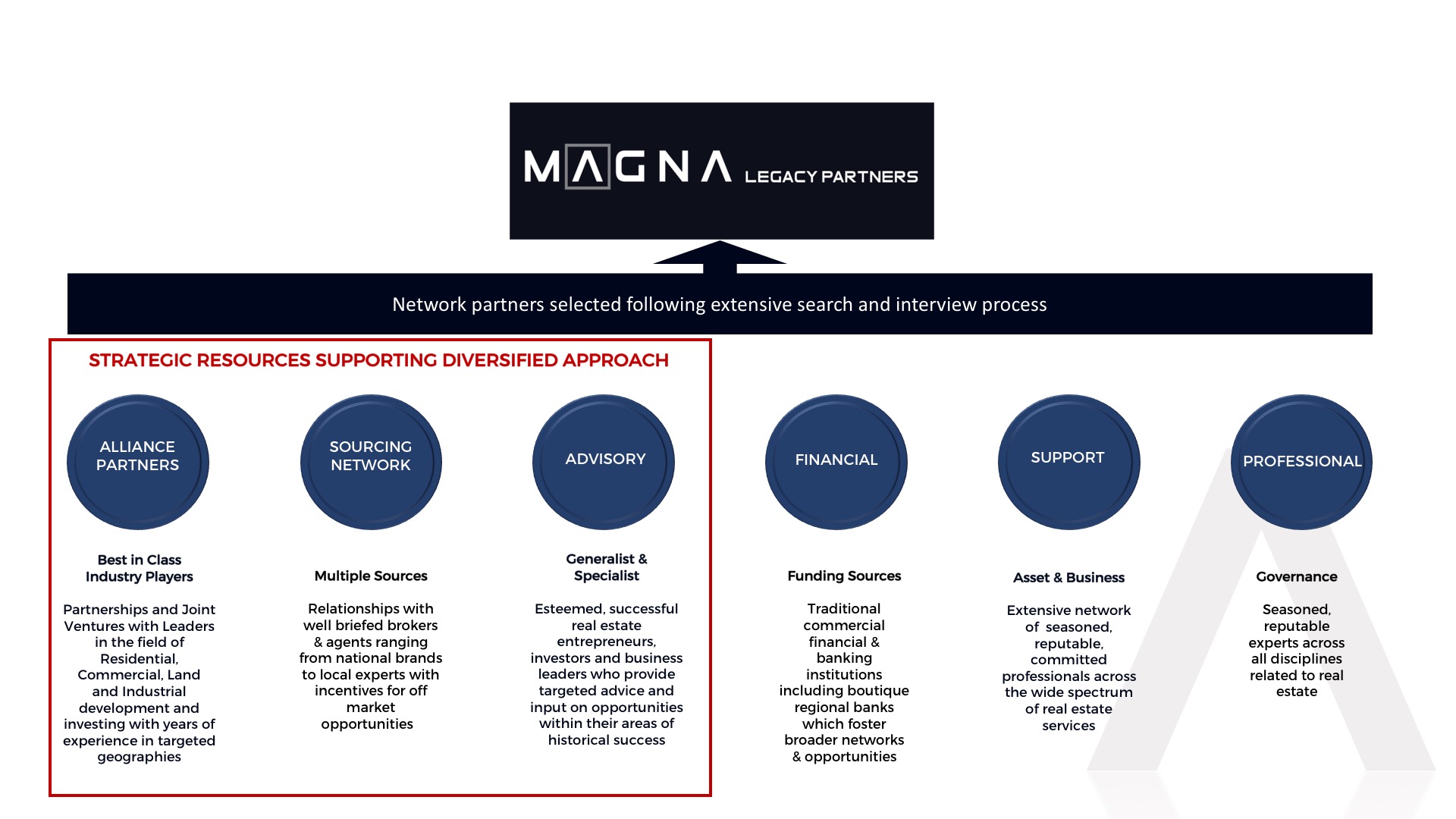

Magna's Extended Network Platform

Leadership

Angelo Giudice: Co-Founder & Principal

Angelo Giudice is one of the Founders and Principals of Magna Legacy Partners (Magna) where he primarily leads the team in strategic execution, sourcing and underwriting qualifying assets as well as direct, co-investment, and secondary investment opportunities with strategic alliance partners.

His career spans nearly three decades incorporating entitlements, construction management, development underwriting, asset management, development of multi-family and master-planned communities as well as hold/sell analysis.

As a natural progression of his formidable career, Angelo founded Magna in 2017 following a pre-launch research and planning phase during which he purposely researched, crafted and fine-tuned the establishment of the Magna foundation in order to bring Magna’s partners compelling, deeply considered real estate investments that would stand the test of time.

Prior to that, Angelo held senior positions with the Westfield Group, LDC Advisors and provided financial analysis and development consulting to CalPERS on legacy assets in a $30Bn real estate portfolio. Angelo was also instrumental in building the family real estate development, consulting and investment business with interests in South Africa and Europe prior to emigrating to the USA.

Angelo has a BS Honors Building Science degree from the University of Witwatersrand (Summa Cum Laude), an MBA graduate degree from The Massachusetts Institute of Technology (MIT), is an Alfred P. Sloan Fellow and professional member with the Chartered Institute of Building (CIOB).

Angelo is married with twin sons and, besides his adoration for his family, enjoys sports with golf, tennis and soccer being among his favorites.

Darren Youngleson: Co-Founder & Principal

Darren Youngleson is one of the Founders and Principals of Magna Legacy Partners (Magna) where he primarily focuses on the healthcare and senior housing strategy, strategic alliances and execution as well as business development and investor relations. His career spans nearly three decades as a Corporate Finance Executive with experience in business strategy, corporate finance, mergers and acquisitions, corporate development, private equity & investor relations.

Darren’s experience includes a decade as head of M&A, Corporate Finance & Investor Relations with Netcare Limited, a healthcare services group which, during his tenure, grew to 120 hospitals, 118 Primary Care and Dental Centers, 88 Pharmacies, interests in Pathology and Radiology, Emergency Services, Managed Care, Dialysis Centers, Travel Clinics, Specialized Medical Centers and entailed extensive travel to various markets which were pursued by the group including, inter alia, countries in Europe, Australasia, North America, the Middle east and Asia. Darren’s final transaction prior to emigrating to the USA in 2006 was the acquisition by Netcare of a controlling interest in the UK-based General Healthcare Group for and enterprise value of ~£2.65 billion.

Prior to Magna, Darren was a Principal of Global Healthcare Investments & Solutions which, among its various pursuits in the United Kingdom, India and Brazil, invested in and developed a public healthcare company in Canada focusing primarily on healthcare services to Seniors. Today that company is the leading specialty pharmacy services provider in Canada.

Darren’s experience spans over 50 transactions valued in excess of $5 billion.

Darren has a Bachelor’s Degrees in Commerce and Accountancy including qualification as a Chartered Accountant (SA). In addition, he has a MBA (Cum Laude) from Edinburgh Business School Heriot-Watt University in the U.K.

Darren is married with a son and daughter, is passionate about family, living life with purpose and enjoys sports with soccer being his unassailable favorite.

Strategic Alliance Partners

Senior Housing

Michael Sieman [DiNapoli Capital Partners]

Michael Sieman is a Vice President at DiNapoli Capital Partners with over $1 billion of commercial real estate transactional experience. In his current role, he oversees the entire deal cycle – acquisitions, asset management, renovations, dispositions, financing and equity sourcing – and the strategy for the senior housing platform. In addition to senior housing, his experience spans multiple asset classes including multifamily, office, retail, hotels, fractured condos, for sale condos, residential home pools, land, performing and non-performing notes and FDIC structured sales.

Prior to joining DiNapoli Capital Partners, Mike worked at Pacifica Companies, an opportunistic real estate investment company based in San Diego that invests throughout the U.S., Mexico, and India. At Pacifica, Mike was a Director of Acquisitions and was responsible for purchasing real estate assets to generate exceptional returns. In this capacity, Mike was responsible for the sourcing, underwriting, and negotiation of real estate transactions. Further, Mike was involved with the creation of new business platforms to take advantage of changing business and economic conditions, including investing in single family home portfolios (both notes and REOs). Prior to Pacifica, Mike worked in public accounting, where he earned his CPA.

Mike holds a Masters Degree in Real Estate from the University of San Diego and a Masters Degree in Accounting from the University of North Carolina at Chapel Hill. He completed his undergraduate education at the University of North Carolina at Chapel Hill as well, with a Bachelor of Science in Business Administration.

Mike lives in San Diego with his wife and dog. He likes to spend his free time outdoors and enjoys hiking, biking, kayaking and playing soccer.

Opportunistic Value Add & Opportunity Zones

Jim Riggs [Founder and CEO: Platinum Advisors]

Real estate entrepreneur focusing on managing and investing in projects located in Scottsdale, Phoenix, Maui and Miami.

Full suite of commercial brokerage and development services.

Assist distressed developers, borrowers, lenders and/or landowners with maximizing depressed or underwater real estate assets.

Developed projects in Scottsdale for 27 years and recently completed the following deals:

1) Built a new 40,000 sq ft, 3 story office building at Bahia and the 101 Freeway, formed and office condo and sold all 5 suites upon shell completion.

2) Purchased 15 acres of "broken retail" at Raintree and 101 in a 2 parcel assemblage; split the parcels into 4 separate lots, rezoned 6 acres for MultiFamily (sold to Wood Partners); sold a vacant Sports Chalet to a storage developer; built and sold a 10,000 sq ft five Tenant strip center and sold off 40,000 of occupied retail. Project duration was 30 months and investor IRR was 40%.

3) Purchased 2 acres (30,000 sq. ft.of under utilized retail) on the South West corner of Scottsdale Road and Bell Road; in escrow to sell to a multi family developer for 240 units.

4) Corporate office was at Raintree and 101 for 15 years with over 100 employees where developed 20 projects in Scottsdale and over 1 million sq ft.

CEO/Founder SAXA, Inc formerly Shea Commercial which, pioneered the development of office condominiums throughout the US. SAXA became the the largest developer of office condominiums in the US and developed a total of more than 5 million square feet of Class A" office condo's including the country's largest office condo project in Scottsdale. Diversified into retail, industrial and mixed use projects in Las Vegas, Dallas, Denver, New York, Hawaii and Florida.

Arizona NAIOP Developer of the Year; 2002, 2003 and 2005

Arizona NAIOP Impact Player of the Year; 2002

Arizona NAIOP Office Building of the Year; 2002, 2005, 2006

Nevada NAIOP Office Building of the Year; 2008

___________________________________________________

Residentially Anchored Mixed Use Projects

Jake von Trapp [Co-Founder and Partner: Columbia Ventures]

Extensive experience in urban infill multifamily development and complex mixed-finance transactions.

Career spans working in the multifamily real estate industry specializing in LIHTC financed transactions; development management responsible for managing the entire spectrum of the real estate development process, completing more than 3,000 units across five communities totaling $168 million.

Track record includes the largest LIHTC transaction in U.S. History, Columbia Parc at the Bayou District in New Orleans, LA. 52-acre master planned public housing revitalization, which includes almost 700 mixed-income multifamily units, an Educare early childhood education center, a 2-acre park and garden and 50,000 square feet of retail, which won numerous national awards including the 2011 National Association of Homebuilders – Pillars of the Industry, Multifamily Community of the Year.

Degrees and membership include: Masters degree in Real Estate Development (MSRED) from the Center for Real Estate at the Massachusetts Institute of Technology (MIT). Certificate in Real Estate Finance from Boston University and a BS in Finance from Boston College. Member of the Urban Land Institute and a 2012 graduate of the ULI Atlanta Center for Leadership.